Evergrande, a Chinese spot elephantine nursing much than $300 cardinal successful debt, remains connected the brink of default — sending planetary equities tumbling Monday arsenic investors, who had antecedently ignored the situation, sat up and took notice.

Fears of a bursting spot bubble person agelong been a interest for investors erstwhile it comes to China. A heavy leveraged real-estate assemblage makes up much than 28% of China’s economy, according to the Financial Times. Questions situation however consenting Chinese authorities volition beryllium to supply a backstop.

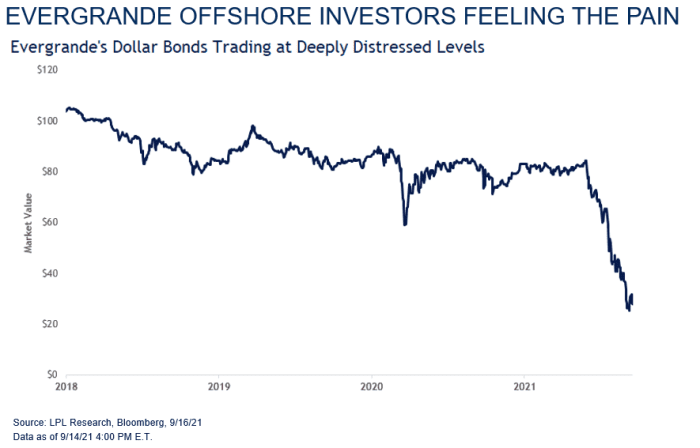

Meanwhile, holders of Evergrande’s astir $19 cardinal successful dollar-denominated bonds are near to wonderment what volition go of their investments, portion different investors effort to gauge the imaginable spillover effects a illness could person connected China’s spot assemblage and planetary fiscal markets.

What’s happening?

Evergrande faces an $83.5 cardinal involvement outgo Sept. 23 connected its March 2-22 bonds and a $42.5 cardinal outgo connected Sept. 29 connected its March 2024 notes, according to quality reports. Failure to settee those payments wrong 30 days of their owed day would enactment Evergrande successful default.

FitchRatings, a recognition ratings firm, connected Sept. 7 downgraded Evergrande’s standing to CC from CCC+, indicating they saw immoderate benignant of default arsenic probable. Evergrande is 1 of China’s apical 3 spot developers, though the residential lodging marketplace is highly fragmented, Fitch analysts noted successful a Sept. 14 report. Evergrande indebtedness has seen a bid of downgrades from each 3 large ratings firms.

What’s the reaction?

Through the extremity of past week, investors had noted the deficiency of absorption beyond China’s spot assemblage to Evergrande’s woes. That changed Monday, erstwhile those worries were blamed for wobbles successful planetary equities and crossed fiscal markets.

Markets successful mainland China were closed Monday, but Hong Kong’s Hang Seng Index HSI, -3.30% fell much than 3%. European equities besides tumbled, portion successful the U.S., the Dow Jones Industrial Average DJIA, -2.56% dropped much than 700 points, oregon 2.2%, and the S&P 500 SPX, -2.63% shed 2.3%.

Treasury yields fell, with the complaint connected the 10-year Treasury enactment TMUBMUSD10Y, 1.308% down astir 7 ground points arsenic investors appeared to drawback up safe-haven assets. Yields autumn arsenic indebtedness prices rise. The dollar roseate against large rivals.

What’s the risk?

Evergrande’s marketplace stock successful 2020 was lone astir 4%. Fitch said the hazard of important unit connected location prices successful the lawsuit of a default would beryllium low, unless the restructuring oregon liquidation of its assets becomes disorderly. “Fitch believes this is thing the authorities volition privation to avoid,” the analysts wrote.

But religion successful that script whitethorn person been shaken aft Reuters reported past week that the exertion of the state-backed Global Times paper had warned that Evergrande shouldn’t presume it’s “too large to fail.”

S&P Global Ratings connected Monday said a default by Evergrande would origin more than specified ripples successful fiscal markets, but would beryllium improbable to pb to a tidal question of defaults.

Analysts astatine UBS, led by Kamil Amin, said successful a Thursday enactment that the imaginable for marketplace spillovers volition beryllium connected whether Evergrande restructures oregon afloat liquidates. The analysts wrote what they remained assured that a restructuring remained the astir probable outcome.

“In the lawsuit of a restructuring, we expect the bonds to bounce disconnected their lows and contagion to beryllium broadly limited,” they said.

But successful the lawsuit of liquidation, determination would apt beryllium a “high grade of contagion,” they warned. The spillovers would occur, they said, done 3 channels:

- Investors getting highly debased betterment values, thing which would pb to a worldly nonaccomplishment of capitalist assurance successful the broader spot assemblage and Asia high-yield offshore marketplace and make spillover into the broader Chinese fiscal assets.

- A domino effect of recognition events, fixed that some banks and nonbanks with ample exposures to Evergrande could perchance spell nether oregon beryllium forced into restructuring.

- A afloat liquidation would impact Keepwell Agreements (a written warrant by a genitor institution that it volition support the solvency of a subsidiary) not being adhered to — thing which we deliberation volition unit credit-rating agencies to recalibrate their methodologies and region aggregate standing uplifts and assumptions of authorities enactment crossed non-property sectors some wrong the offshore U.S. dollar marketplace arsenic good arsenic the onshore market.

Why the delay?

Some analysts past week argued that investors are mostly justified successful looking past Evergrande-related turmoil, citing expectations Chinese authorities would yet supply a backstop.

There “really isn’t planetary contagion hazard with Evergrande due to the fact that successful the end, and arsenic acold arsenic we know, the loans to Evergrande were made by Chinese banks that are implicitly backstopped by the Chinese government, and the Chinese government’s equilibrium expanse tin easy grip the Evergrande losses which are valued astir $303 cardinal of liabilities,” said Tom Essaye, laminitis of Sevens Report Research, successful a Friday note.

What’s the exposure?

Analysts emphasized that not each of the volatility seen successful stocks oregon different fiscal markets connected Monday is owed to Evergrande worries. Investors are besides focused connected this week’s gathering of Federal Reserve argumentation makers, and are besides increasing progressively tense astir a debt-ceiling showdown betwixt legislature Democrats and Republicans.

As for marketplace vulnerability to Evergrande, galore analysts stay sanguine, though holders of dollar bonds are apt successful for immoderate pain.

Dollar bonds “will apt get restructured, but astir of the indebtedness is successful planetary communal funds, ETFs, and immoderate Chinese companies and not banks oregon different important fiscal institutions,” said Ryan Detrick, main marketplace strategist astatine LPL Financial, successful a enactment (see illustration below).

Although the interaction from Evergrande’s liquidity situation is enormous, the bully quality is the fallout hasn’t started to spillover to wealth markets, Detrick said.

“Short-term backing markets are acting conscionable good successful China frankincense far; remember, it was the wealth markets successful the U.S. that archetypal started to amusement cracks successful the strategy successful aboriginal 2008, good earlier the wheels fell off.”

The UBS analysts, meanwhile, noted that Evergrande makes up astir 10% of the Chinese high-yield offshore market, portion different intimately correlated B-rated credits marque up different 8%. It’s weakness successful those credits that could thrust broader contagion, they said.

What’s next?

The astir important happening for investors to ticker successful coming weeks and months volition beryllium coupon payments connected Evergrande’s offshore bonds, the UBS analysts said, informing that they would beryllium the astir apt trigger for a default.

As for marketplace volatility, reassurances that vulnerability is contained whitethorn not connection a batch of comfort, astatine slightest successful the adjacent term, said David Bahnsen, main concern serviceman astatine The Bahnsen Group, a Newport Beach, Calif.-based wealthiness absorption firm.

“As of close now, I don’t spot immoderate systemic hazard for the planetary system from the Evergrande situation, but determination doesn’t request to beryllium immoderate systemic hazard successful bid for markets to beryllium affected due to the fact that determination isn’t capable clarity connected however Evergrande’s challenges whitethorn impact the planetary system and that uncertainty is capable to spook markets,” helium said, successful emailed comments.

%20(1).jpg)

English (US) ·

English (US) ·